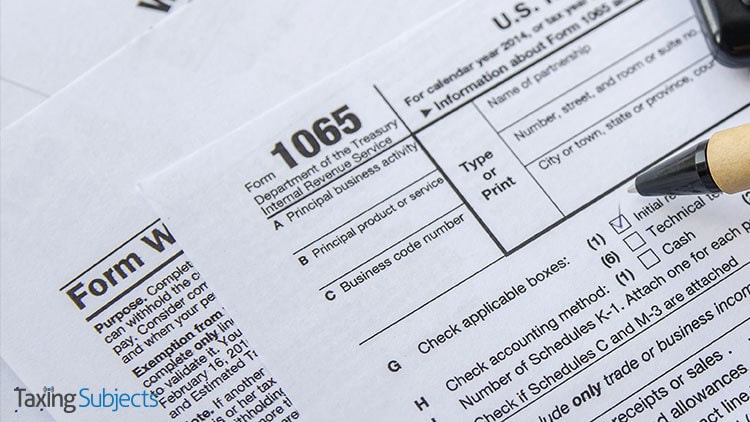

The legislative history for § 6698 suggests that lawmakers intended this “reasonable cause” exception to protect small partnerships that did not file a partnership return: While there is no statutory exception to the § 6031(a) filing requirement for any partnership (regardless of size), the CCA explains that the § 6698 penalty may be avoided if it is shown that the failure to file a complete or timely return was due to “reasonable cause.” In 2017, these penalties are $200 per month per partner (for a period up to 12 months). The CCA began with the proposition that IRC § 6031(a) requires partnerships to file partnership returns and that when they don’t, they are generally subject to an IRC § 6698 penalty. The taxpayer seeking the advice acknowledged that “a small partnership is not relieved of the filing requirement,” but sought confirmation for the contention that they have “almost automatic reasonable cause relief for the failure to file a partnership return.” With this assertion, the CCA did not concur. It also raises the question of how this provision will be applied in 2018, after new partnership audit rules are implemented. Yet, the advice very clearly sets forth the IRS position on this matter, which is very important to many agricultural partnerships.

United States, and Internal Revenue Manual procedures detailing the requirements for applying Rev.

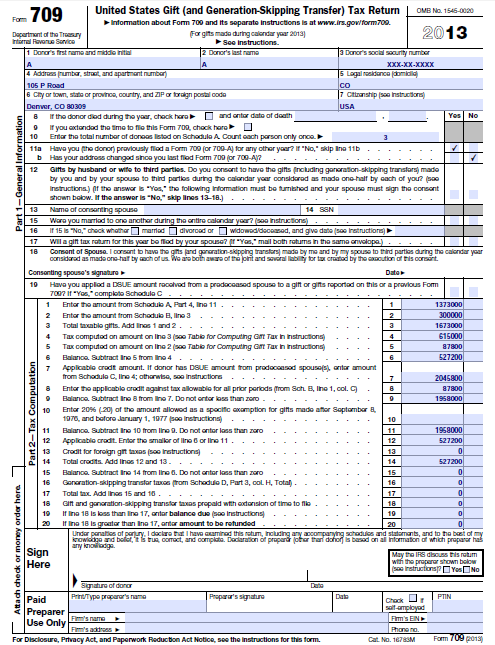

The conclusion of the CCA 201733013 was not a surprise, especially in light of the 2015 case of Battle Flat, LLC v. Return of Partnership Income, because of Rev. IRS’ Office of Chief Counsel recently weighed in on an important question for small partnerships: Are they automatically exempted from the requirement of filing a Form 1065, U.S.

0 kommentar(er)

0 kommentar(er)